To choose the best health insurance for your family, compare coverage options and costs. Consider your family’s specific medical needs.

Selecting the right health insurance is crucial for your family’s well-being. With numerous plans available, it can be overwhelming to decide which one is best. Start by evaluating the coverage options each plan offers. Look at what is included, such as doctor visits, hospital stays, and prescription medications.

Next, compare the costs, including premiums, deductibles, and co-pays. Ensure the plan fits within your budget while still meeting your family’s healthcare needs. Also, check if your preferred healthcare providers are in the network. Making an informed decision will provide peace of mind and ensure your family has access to necessary medical care.

Assess Your Family’s Needs

Assessing your family’s needs involves evaluating key aspects of your family’s daily life, goals, and future plans. Here’s a simple guide to help you assess various areas:

1. Health and Well-Being

- Physical Health: Consider any ongoing health conditions, necessary medical care, or medications. Is everyone getting regular check-ups, and do you have access to healthcare services?

- Mental Health: Think about emotional well-being, stress levels, and any mental health support that may be needed.

- Fitness and Nutrition: Are your family members eating well and staying physically active?

2. Financial Security

- Income: Is your household income stable? Do you have a reliable source of income?

- Budgeting: Are you managing expenses effectively? Do you track spending and savings?

- Savings: Do you have an emergency fund, savings for future goals (education, retirement, etc.), and insurance to protect against unforeseen events?

3. Housing and Living Environment

- Home Safety: Is your home safe and comfortable? Consider the condition of your living space and any necessary repairs or upgrades.

- Space Needs: Do you have enough space for everyone? Is your living environment conducive to your family’s lifestyle?

- Community: Is your neighborhood supportive, safe, and aligned with your family’s values (schools, recreational facilities, etc.)?

4. Education and Personal Growth

- Children’s Education: Are your children in a supportive and enriching learning environment? Consider their academic progress and future education goals.

- Adult Learning: Are there opportunities for you or your partner to pursue personal or professional development?

- Hobbies and Interests: Are family members able to explore their interests and hobbies?

5. Work-Life Balance

- Time Management: Are you balancing work, family time, and personal time well? Are there opportunities to improve the balance?

- Work Environment: Do you have a supportive work situation? Are there any career changes or transitions you need to prepare for?

- Childcare Needs: Do you need support with childcare, and is it affordable and reliable?

6. Long-Term Planning

- Future Goals: What are your family’s long-term goals (home ownership, travel, career aspirations)?

- Retirement: Are you planning for retirement? Do you need to increase your savings or adjust your financial plan?

- Legal Documents: Do you have wills, health directives, or other legal documents in place?

By considering these areas, you can get a clearer picture of what is going well and where adjustments might be needed. Would you like to dive deeper into any specific area of family needs?

Choosing the best health insurance for your family starts by understanding everyone’s needs. This helps ensure comprehensive coverage and peace of mind.

Evaluate Current Health Conditions

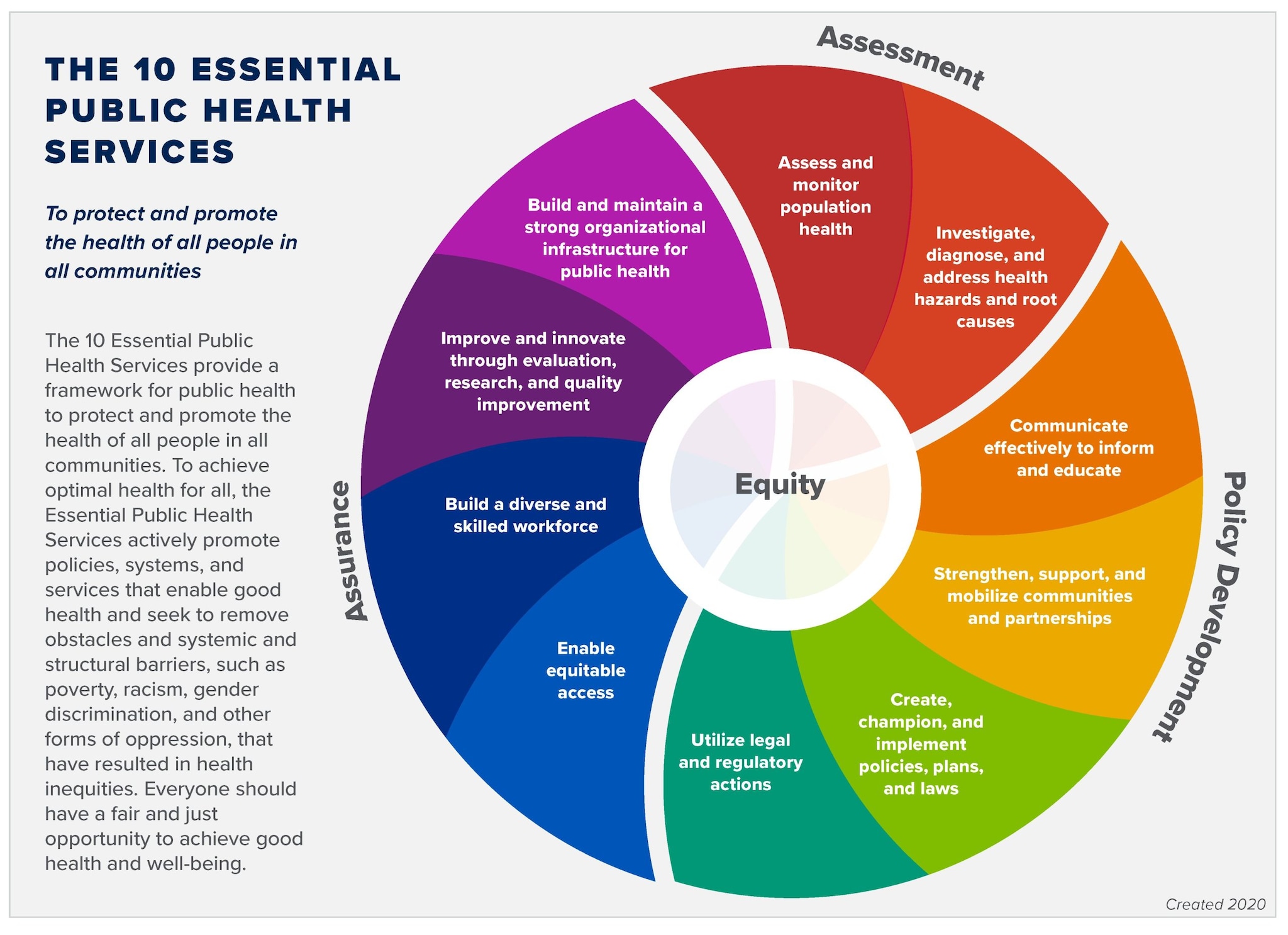

10 Essential Public Health Services (Revised, 2020)

- Assess and monitor population health status, factors that influence health, and community needs and assets

- Investigate, diagnose, and address health problems and hazards affecting the population

- Communicate effectively to inform and educate people about health, factors that influence it, and how to improve it

- Strengthen, support, and mobilize communities and partnerships to improve health

- Create, champion, and implement policies, plans, and laws that impact health

- Utilize legal and regulatory actions designed to improve and protect the public’s health

- Assure an effective system that enables equitable access to the individual services and care needed to be healthy

- Build and support a diverse and skilled public health workforce

- Improve and innovate public health functions through ongoing evaluation, research, and continuous quality improvement

- Build and maintain a strong organizational infrastructure for public health

Resources

First, list any current health conditions your family members have. This includes chronic illnesses, allergies, and ongoing treatments. Consider the frequency of doctor visits and required medications. Knowing these details helps you choose a plan with adequate coverage and lower out-of-pocket costs.

Make a table to organize this information:

| Family Member | Health Condition | Frequency of Doctor Visits | Medications |

|---|---|---|---|

| John | Asthma | Monthly | Inhaler |

| Jane | Diabetes | Quarterly | Insulin |

Consider Future Health Risks

When considering future health risks for your family, it’s important to be proactive in both identifying potential concerns and planning for them. Here’s how you can assess and prepare for possible health risks:

1. Family Medical History

- Genetic Conditions: Identify any hereditary diseases or conditions that run in your family (e.g., heart disease, diabetes, cancer, mental health issues). Knowing these risks helps with early detection and prevention.

- Lifestyle-Related Conditions: Consider conditions related to lifestyle factors, such as high blood pressure or obesity, and whether family habits may contribute to these risks.

2. Aging and Chronic Conditions

- Age-Related Health Issues: As family members age, risks for conditions like arthritis, osteoporosis, dementia, or cardiovascular disease may increase. Planning for regular screenings and managing diet and exercise can help mitigate these risks.

- Chronic Conditions: If someone already has a chronic condition (e.g., asthma, diabetes, hypertension), how is it being managed? Ensure you have a long-term care plan, including medication management, lifestyle adjustments, and access to necessary healthcare services.

3. Environmental and Lifestyle Factors

- Diet and Exercise: Evaluate your family’s eating habits and physical activity levels. A poor diet and lack of exercise can increase the risk of obesity, heart disease, and other conditions. Making small lifestyle changes now can help prevent future health problems.

- Stress and Mental Health: Chronic stress can lead to mental health issues such as anxiety, depression, or burnout. Do family members have effective stress management techniques? Mental health check-ins and promoting a healthy work-life balance can be crucial.

- Sleep Habits: Sleep is a major component of overall health. Poor sleep quality or irregular patterns can contribute to mental health problems, heart disease, and other chronic conditions.

4. Preventative Healthcare

- Vaccinations: Ensure your family is up to date on all necessary vaccines, including flu shots, COVID-19 vaccines, and other relevant immunizations based on age and travel plans.

- Regular Screenings: Encourage regular check-ups, blood tests, and screenings for conditions like cancer (e.g., mammograms, colonoscopies), diabetes, and cholesterol levels. Early detection is key to preventing complications.

5. Mental Health and Cognitive Decline

- Mental Health Care: Mental health issues such as depression, anxiety, and stress are common, and early intervention can prevent more serious problems later. Consider therapy, counseling, or support groups if needed.

- Cognitive Decline: For older family members, consider the risk of Alzheimer’s disease, dementia, or other cognitive impairments. Brain health can be maintained through mental stimulation, a healthy diet, physical activity, and social engagement.

6. Health Insurance and Financial Preparedness

- Comprehensive Health Coverage: Make sure your health insurance covers preventive care, chronic conditions, and potential emergencies. Consider if additional coverage (e.g., dental, vision, long-term care) is needed for future needs.

- Emergency Savings for Health Costs: Unexpected health issues can be financially draining. Ensure your family has an emergency fund to cover health-related costs not covered by insurance, such as out-of-pocket expenses or long-term care.

7. Emerging Health Risks

- Global and Local Health Trends: Stay informed about emerging health risks, such as the potential for new infectious diseases (pandemics), environmental risks (pollution, allergens), or lifestyle-related health trends.

- Climate Change: Consider how climate change might affect health, such as increased risks of heat-related illnesses, vector-borne diseases (e.g., Lyme disease, Zika), or respiratory issues due to pollution.

8. Emergency Preparedness

- First Aid and CPR Training: Make sure family members know basic first aid and CPR, especially if anyone has a higher risk of health emergencies like heart attacks or severe allergic reactions.

- Medical Supplies: Keep essential medical supplies and medications in stock, including items for treating common illnesses and managing chronic conditions.

Next, think about potential future health risks. This includes any hereditary conditions or lifestyle factors. If your family has a history of heart disease, consider a plan with strong cardiac care coverage. Lifestyle factors like smoking or high stress can also impact future health.

Here are some questions to help:

- Does anyone smoke or have high stress levels?

- Is there a family history of certain diseases?

- Are there any upcoming life changes, like pregnancy?

Evaluating these risks ensures your health insurance covers potential future needs. This proactive approach helps avoid unexpected medical expenses.

Understand Policy Types

Choosing the best health insurance for your family can indeed feel overwhelming, but breaking the process down into key steps and understanding your family’s unique needs can simplify it. Here’s a guide to help you make the best choice:

1. Assess Your Family’s Health Needs

- Medical History: Review any existing conditions, frequent doctor visits, medications, or ongoing treatments. Does anyone in the family have chronic conditions like asthma, diabetes, or hypertension that need regular management?

- Future Healthcare Needs: Consider potential future needs, such as planned surgeries, maternity care, or mental health services.

- Preventive Care: Is your family generally healthy and only needs coverage for routine check-ups, vaccinations, and screenings?

2. Understand the Types of Health Plans

- Health Maintenance Organization (HMO): Offers lower premiums and requires you to use a network of doctors and hospitals. You need a referral from a primary care doctor to see a specialist.

- Preferred Provider Organization (PPO): Higher premiums but offers more flexibility in choosing healthcare providers, and you don’t need referrals to see specialists. You can also see out-of-network providers, although at a higher cost.

- Exclusive Provider Organization (EPO): Similar to an HMO but with more flexibility in seeing specialists without a referral. You must stay within the network to receive coverage, except for emergencies.

- Point of Service (POS): Combines elements of HMO and PPO plans. You need a referral for specialists, but you can see out-of-network providers at a higher cost.

- High Deductible Health Plan (HDHP) with Health Savings Account (HSA): These plans have lower premiums but high deductibles. The HSA allows you to save pre-tax money for medical expenses.

3. Compare Coverage Benefits

- In-Network vs. Out-of-Network: Look at the network of healthcare providers. Does the plan include your preferred doctors, hospitals, and specialists?

- Prescription Coverage: If anyone in the family takes regular medications, check the plan’s formulary to see if your prescriptions are covered and how much you’ll pay.

- Maternity and Childcare: If you’re planning to expand your family, ensure maternity and newborn care are included. For families with young children, review pediatric care and immunization coverage.

- Specialist Care and Mental Health: Check if the plan covers visits to specialists, mental health professionals, or other specific treatments like physical therapy or alternative medicine (e.g., chiropractic care).

4. Examine the Costs

- Premiums: This is the monthly amount you’ll pay for the plan. Generally, lower premiums mean higher out-of-pocket costs, and higher premiums provide more comprehensive coverage.

- Deductibles: The amount you need to pay out-of-pocket before your insurance starts covering services. Plans with lower deductibles may have higher premiums.

- Copays and Coinsurance: After meeting your deductible, you may still need to pay a copay (a fixed fee per visit) or coinsurance (a percentage of the cost). Compare these costs for different services.

- Out-of-Pocket Maximum: This is the most you’ll pay in a year before insurance covers 100% of covered costs. This is a crucial factor in limiting your financial exposure, especially in case of a serious illness or accident.

5. Consider Flexibility and Convenience

- Provider Networks: Ensure that your family’s primary care physicians and specialists are in-network. If you prefer seeing specific doctors or have any ongoing treatments, you’ll want to avoid a plan that limits those choices.

- Telemedicine Services: Many families find value in telemedicine, especially for minor illnesses, mental health consultations, and follow-up appointments. Check if your plan covers these services and at what cost.

- Urgent and Emergency Care: Understand the costs for urgent care visits versus emergency room visits. Plans often handle these differently.

6. Evaluate Additional Benefits

- Dental and Vision Coverage: Some plans include dental and vision coverage, while others may offer it as an add-on. For families with children, regular dental and vision check-ups are essential.

- Wellness Programs: Look for health plans that offer wellness incentives, such as gym membership discounts, weight-loss programs, smoking cessation support, or family health education resources.

- Mental Health and Behavioral Health: If anyone in the family needs mental health support, ensure the plan covers counseling, therapy, or psychiatric care.

7. Check if the Plan Offers a Health Savings Account (HSA)

- Tax Benefits: If you choose a High Deductible Health Plan (HDHP), you may be eligible to open an HSA. Contributions to this account are tax-free, and funds can be used to pay for qualified medical expenses.

- Savings for Future Healthcare Needs: HSA funds roll over year to year and can be saved for future healthcare expenses. This can be especially beneficial if you’re planning for future medical expenses like surgeries or long-term treatments.

8. Review Policy Exclusions and Limitations

- Exclusions: Carefully review the plan to see what isn’t covered. Some policies exclude treatments like cosmetic surgery, infertility treatments, or alternative therapies.

- Pre-Existing Conditions: Check if the plan has any waiting periods or restrictions on pre-existing conditions (though under the Affordable Care Act, most plans cannot deny coverage based on pre-existing conditions).

9. Consider the Future

- Anticipated Changes: Are there any life events (e.g., having another child, moving, switching jobs) that could impact your healthcare needs? Choose a plan that can accommodate these changes.

- Long-Term Coverage: Some plans may offer better long-term protection for conditions that could arise as your family grows older.

10. Seek Professional Guidance

- Insurance Brokers: Consider consulting an insurance broker who can provide advice tailored to your family’s situation and compare multiple plans.

- Employer-Sponsored Plans: If you’re choosing from an employer-sponsored plan, carefully review the benefits and talk to the HR department if you need clarification.

Would you like specific recommendations for family health insurance, or help comparing options available to you?

Choosing the best health insurance for your family can be daunting. Understanding the different policy types is crucial. This section will help you understand the main types of health insurance policies. Knowing these types will guide you in making an informed decision.

Hmo Vs. Ppo

HMO stands for Health Maintenance Organization. PPO stands for Preferred Provider Organization. Both offer unique advantages and limitations.

| HMO | PPO |

|---|---|

| Lower premiums | Higher premiums |

| Must use in-network doctors | Can use out-of-network doctors |

| Requires a primary care doctor | No need for a primary care doctor |

| Referrals needed for specialists | No referrals needed |

HMO plans are usually more affordable. They require you to choose a primary care doctor. You need a referral to see a specialist. PPO plans offer more flexibility. You can see any doctor without a referral. They are more expensive but offer greater freedom.

High-deductible Plans

High-Deductible Health Plans (HDHPs) have lower premiums. They require you to pay more out-of-pocket before the insurance starts covering costs. These plans are paired with Health Savings Accounts (HSAs). HSAs let you save money tax-free for medical expenses.

- Lower monthly premiums

- Higher out-of-pocket costs initially

- Eligible for Health Savings Accounts

HDHPs can be beneficial if you are healthy and do not expect many medical expenses. The HSA can help you save money for future healthcare costs. The combination of low premiums and tax savings is attractive for many families.

Compare Coverage Options

Choosing the best health insurance for your family can be overwhelming. Comparing coverage options is a crucial step. This will help you understand what each plan offers. Below are some essential factors to consider:

Inclusions And Exclusions

Health insurance plans come with various inclusions and exclusions. Inclusions are services your plan covers. Exclusions are services it does not cover. Understanding both is vital.

| Inclusions | Exclusions |

|---|---|

| Doctor visits | Cosmetic surgeries |

| Emergency care | Experimental treatments |

| Maternity care | Fertility treatments |

Check the inclusions and exclusions carefully. This will help you avoid surprises later.

Prescription Drug Coverage

Prescription drug coverage is another crucial factor. Medications can be expensive. Ensure your plan covers the drugs you need.

- Check if your regular medications are included.

- Find out the co-payment or co-insurance for drugs.

- Look for generic drug coverage to save costs.

Understanding prescription drug coverage can save you a lot of money. Make sure you review this part thoroughly.

By comparing these aspects, you can choose the best health insurance plan for your family.

Consider Network Restrictions

How to Consider Network Restrictions When Choosing Health Insurance

Network restrictions play a significant role in determining the quality and cost-effectiveness of your health insurance. Here’s how to navigate them wisely:

1. Understand Network Types

- HMO (Health Maintenance Organization): Requires you to use in-network providers and get referrals for specialists.

- PPO (Preferred Provider Organization): Offers flexibility to see out-of-network providers at higher costs.

- EPO (Exclusive Provider Organization): Covers only in-network care unless it’s an emergency.

- POS (Point of Service): Combines HMO and PPO features, requiring a referral for specialists but allowing out-of-network care at a cost.

2. Check Your Preferred Providers

- Verify if your primary care physician, specialists, and preferred hospitals are in the network.

- Look for a plan that includes providers near your home or workplace for convenience.

3. Assess the Network Size

- A larger network increases your options for doctors, hospitals, and specialists.

- Smaller networks may offer lower premiums but could limit access to quality care.

4. Evaluate Specialist Access

- Check if you need referrals for specialists and whether those specialists are in-network.

- Consider plans with direct access to specialists if you have ongoing medical needs.

5. Be Aware of Out-of-Network Costs

- Understand how much more you’ll pay for using out-of-network providers.

- Some plans only cover emergencies outside the network, leaving you responsible for all other costs.

6. Consider Multi-State or Travel Needs

- If you travel often or live in multiple states, look for a plan with a broad network or national coverage.

7. Use Online Tools

- Insurers often have directories to help you search for in-network providers. Use these to ensure accessibility.

8. Read Reviews and Ratings

- Look for feedback on the network’s quality, such as ease of finding providers and wait times for appointments.

9. Check for Updates

- Networks can change yearly. Ensure your current providers remain in-network when renewing or switching plans.

10. Balance Costs and Convenience

- A narrow network might save you money but could require traveling farther for care.

- Weigh the trade-offs between lower premiums and the availability of local, trusted providers.

Being mindful of network restrictions ensures you have affordable and accessible healthcare that meets your needs.

Choosing the best health insurance for your family can be challenging. One critical factor is network restrictions. These restrictions determine which doctors and hospitals you can use. Understanding these restrictions helps ensure you get the best care without unexpected costs.

In-network Vs. Out-of-network

Health insurance plans often have in-network and out-of-network providers. In-network providers have agreements with your insurance. These agreements usually mean lower costs for you. Out-of-network providers do not have these agreements. This often results in higher costs.

Using in-network providers can save you money. Check the provider list before choosing a plan. This ensures your family’s doctors are included. If you use out-of-network providers, expect higher charges. These costs can add up quickly.

Specialist Access

Access to specialists is another important consideration. Some plans require a referral from your primary doctor. This means you need approval to see a specialist. Other plans allow you to see specialists directly.

Check if your plan requires referrals. This can affect how quickly you get specialist care. If your family needs frequent specialist visits, choose a plan without referral requirements. This ensures quicker access to the care you need.

Always review the specialist list in your network. Make sure the specialists you need are included. This avoids unexpected costs and ensures timely care.

Review Costs And Premiums

:max_bytes(150000):strip_icc():format(webp)/InsurancePremium_Final_4194539-49c5df26fba746b0b9d16de6e302fdf5.jpg)

Choosing the best health insurance for your family can be challenging. One of the most important factors to consider is the cost. Reviewing costs and premiums helps you understand what you will pay each month and out-of-pocket. This guide will help you navigate these expenses.

Monthly Premiums

The monthly premium is the amount you pay every month for your health insurance. It’s important to compare the premiums of different plans. Higher premiums often mean lower out-of-pocket costs. Here’s a simple table to help you compare:

| Plan | Monthly Premium |

|---|---|

| Plan A | $300 |

| Plan B | $450 |

| Plan C | $600 |

Choose a plan with a premium that fits your budget. Remember, higher premiums can offer more coverage.

Out-of-pocket Expenses

Out-of-pocket expenses include deductibles, co-pays, and co-insurance. These are costs you pay in addition to your monthly premium. Understanding these costs helps you prepare for medical expenses.

- Deductible: The amount you pay before the insurance starts covering costs. Lower deductibles mean higher premiums.

- Co-pay: A fixed amount you pay for a service, like a doctor’s visit.

- Co-insurance: Your share of the costs after the deductible is met. For example, you pay 20% and the insurance pays 80%.

Consider these out-of-pocket costs when selecting a plan. A lower monthly premium might mean higher out-of-pocket costs. Make sure you choose what works best for your family’s needs.

Check For Additional Benefits

How to Check for Additional Benefits in Health Insurance Plans

Beyond basic coverage, many health insurance plans offer extra benefits that can enhance your healthcare experience and save money. Here’s how to identify and evaluate these additional perks:

1. Preventive Care Services

- Look for benefits like free annual checkups, vaccinations, health screenings, and wellness exams.

- Confirm that these services are included without extra cost.

2. Mental Health Coverage

- Ensure the plan covers therapy, counseling, psychiatric visits, and medications for mental health conditions.

- Check for telehealth options for mental health support.

3. Prescription Drug Benefits

- Review the formulary (list of covered drugs) to ensure your medications are included.

- Look for discounts or free generic drugs.

4. Telemedicine Services

- Many plans offer virtual doctor consultations for minor illnesses or follow-ups, saving time and costs.

5. Maternity and Newborn Care

- If you’re planning a family, ensure the plan includes prenatal visits, delivery costs, and postpartum care.

- Check if newborn care is covered immediately after birth.

6. Vision and Dental Coverage

- Some plans offer add-ons or include basic dental and vision benefits, such as eye exams, glasses, cleanings, and fillings.

7. Wellness Programs

- Look for incentives like gym membership discounts, weight loss programs, smoking cessation support, or cashback for healthy habits.

8. Chronic Disease Management

- Check if the plan includes programs for managing conditions like diabetes, hypertension, or asthma, including free supplies or coaching.

9. Alternative Therapies

- Some policies cover acupuncture, chiropractic care, or physiotherapy sessions.

10. Coverage for Dependents

- Ensure children or other dependents are eligible for comprehensive care, including pediatric services.

11. Emergency and Urgent Care

- Review how the plan handles emergency services, including ambulance costs, out-of-network emergency care, and urgent care visits.

12. International Coverage

- If you travel frequently, check if the policy includes global health coverage or travel insurance benefits.

13. Home Healthcare Services

- Look for benefits like home visits from nurses or telemonitoring for post-surgery or chronic condition care.

14. Discounts and Perks

- Some insurers provide discounts on fitness equipment, wellness apps, health products, or even alternative therapies.

15. Health Savings Account (HSA) Eligibility

- High-deductible plans may allow you to save pre-tax dollars in an HSA to pay for medical expenses.

16. Second Opinion Services

- Access to expert second opinions can be invaluable for critical diagnoses or complex treatments.

17. Access to Specialists Without Referrals

- Some plans eliminate the need for referrals to see specialists, making healthcare access more convenient.

18. Customer Support and Tools

- Check if the insurer offers 24/7 support, mobile apps, or online portals to manage your coverage and claims.

How to Check

- Policy Documents: Read the full policy terms or brochure.

- Ask Questions: Speak to a representative to clarify any benefits you’re unsure about.

- Compare Plans: Use online comparison tools or consult an expert.

Taking advantage of these additional benefits can enhance your health insurance plan and improve your overall healthcare experience.

Choosing the best health insurance for your family is crucial. One important factor to consider is the additional benefits offered. These benefits can make a big difference in your overall health and savings.

Wellness Programs

Many health insurance plans offer wellness programs to keep you healthy. These programs might include:

- Free gym memberships

- Nutrition counseling

- Weight management programs

- Smoking cessation support

Wellness programs focus on prevention. They help you stay fit and avoid illnesses. Check if your plan covers these features. They can save you money and improve your health.

Telemedicine Services

Telemedicine services are becoming more popular. These services let you consult doctors online. You can get medical advice without leaving home. Look for plans that offer:

- 24/7 access to healthcare professionals

- Video consultations with doctors

- Online prescription services

Telemedicine is convenient and time-saving. It can be especially helpful for minor illnesses. Ensure your health insurance includes these services. It adds value and accessibility to your healthcare.

| Benefit | Details |

|---|---|

| Wellness Programs | Gym memberships, nutrition counseling, weight management, smoking cessation |

| Telemedicine Services | 24/7 healthcare access, video consultations, online prescriptions |

Read Customer Reviews

Choosing the best health insurance for your family can be tough. Reading customer reviews can help. Reviews give you real-life experiences from other families.

Satisfaction Ratings

Yes, satisfaction ratings can be a valuable tool in determining how happy people are with their health plans. These ratings typically measure various aspects of the health plan experience, giving you insight into what others think about the service and coverage. Here’s what they generally include:

1. Customer Service:

- How responsive and helpful the customer service representatives are when handling questions, claims, or issues.

- Ease of communication (online portals, phone support, etc.).

2. Claims Process:

- Speed and ease of submitting claims.

- Whether claims are processed accurately and quickly.

- Transparency in explaining coverage decisions.

3. Provider Network Satisfaction:

- How satisfied users are with the network of doctors, hospitals, and specialists available.

- Ease of getting referrals (if required) and scheduling appointments.

4. Affordability:

- How satisfied people are with the cost of premiums, deductibles, copays, and out-of-pocket maximums.

- The perception of whether the plan offers good value for the price.

5. Coverage Options:

- Satisfaction with the range of services covered, such as preventive care, prescriptions, mental health, and specialist care.

- Whether there are enough choices to tailor coverage to family needs.

6. Plan Communication and Education:

- How well the insurer explains benefits, coverage changes, and policy details.

- Clarity of communication around billing, claims, and benefits.

7. Prescription Coverage:

- How happy users are with their plan’s prescription drug coverage, including the range of covered medications and out-of-pocket costs.

8. Convenience:

- Whether the plan offers modern conveniences like telehealth services, mobile apps, or online account management tools.

- Ease of accessing care (wait times, appointment availability).

Looking at these satisfaction ratings, you can get a good sense of what health plans are best received by users and match them with your family’s preferences. Would you like help reviewing any specific health plans based on ratings?

Satisfaction ratings show how happy people are with their health plans. Look for high ratings. They mean most people like the service. Low ratings can mean problems. Happy customers often talk about good customer service and easy claims.

Claims Process Efficiency

The claims process should be quick and easy. Read reviews about this process. People often share how long it took to get their claims processed. Fast claims mean less stress for your family. Long wait times can be a red flag.

| Aspect | Positive Reviews | Negative Reviews |

|---|---|---|

| Satisfaction Ratings | High customer satisfaction | Frequent complaints |

| Claims Process | Quick and easy claims | Long wait times |

- Read reviews to know about customer experiences.

- High satisfaction ratings mean happy customers.

- Easy claims process reduces stress.

- Check satisfaction ratings first.

- Read about the claims process.

- Look for consistent feedback.

Consult With An Expert

Choosing the best health insurance for your family can be tough. Consulting with an expert can simplify this process. Experts have the knowledge and experience to guide you. They can help you understand various plans and find the best fit for your needs.

Insurance Brokers

Yes, insurance brokers are licensed professionals who specialize in health insurance and act as intermediaries between individuals or businesses and insurance carriers. Their role involves navigating the complexities of the insurance market to help clients identify the most suitable health plans based on their specific needs and financial constraints.

Key Functions of Health Insurance Brokers:

-

Needs Assessment:

- Brokers conduct a thorough risk assessment and coverage needs analysis. They evaluate factors such as family size, medical history, and required network coverage to recommend appropriate plans.

-

Market Comparison:

- Using their industry knowledge, brokers compare offerings from multiple insurance providers, analyzing variables like premiums, deductibles, coinsurance, and out-of-pocket maximums. This helps in optimizing cost-efficiency while ensuring adequate coverage.

-

Regulatory Compliance:

- Brokers ensure that the policies they recommend comply with local and national regulations, such as ACA (Affordable Care Act) mandates in the U.S. or other relevant frameworks in different regions.

-

Claims Assistance:

- Many brokers provide post-enrollment services, including helping clients with claims disputes, ensuring accurate reimbursement, and navigating appeals in case of denied claims.

-

Negotiation and Advocacy:

- They may also advocate on behalf of clients, negotiating better premiums or more favorable coverage terms by leveraging their relationships with insurers.

-

Policy Renewal and Review:

- Brokers assist with annual policy reviews to ensure the health plan remains aligned with any changes in family circumstances, healthcare needs, or industry regulations. This might involve switching to a new provider or adjusting existing coverage.

-

Access to Group Plans:

- For businesses or larger families, brokers can facilitate access to group health insurance plans, which often provide more comprehensive coverage at reduced costs compared to individual policies.

Working with a health insurance broker can significantly reduce the administrative burden and complexity involved in choosing the right plan, particularly when dealing with various providers and policy options. Would you like assistance in finding a broker or more details on how to leverage their services effectively?

Insurance brokers are professionals who specialize in health insurance. They can offer personalized advice based on your family’s needs. Brokers have access to a wide range of insurance plans. This allows them to compare options and find the best deal for you.

- Personalized Advice: Brokers understand your unique needs.

- Plan Comparison: They compare multiple plans to find the best fit.

- Expert Knowledge: Brokers stay updated on the latest insurance trends.

Using a broker can save you time and money. Their expertise ensures you choose a plan that offers the best coverage at the best price.

Financial Advisors

Financial advisors can also help you choose the right health insurance. They look at your overall financial situation. This helps them recommend a plan that fits your budget and meets your family’s needs.

- Budget Analysis: Advisors assess your financial status.

- Comprehensive Planning: They consider all aspects of your finances.

- Future-Proofing: Advisors help plan for long-term health costs.

Consulting a financial advisor ensures your health insurance aligns with your financial goals. This holistic approach can provide peace of mind for your family.

| Expert Type | Benefits |

|---|---|

| Insurance Brokers | Personalized advice, plan comparison, expert knowledge |

| Financial Advisors | Budget analysis, comprehensive planning, future-proofing |

Frequently Asked Questions

What Should I Consider When Choosing Health Insurance?

Consider coverage options, premium costs, deductibles, and network providers. Evaluate your family’s medical needs and financial situation. Compare plans and read reviews.

How Do I Compare Health Insurance Plans?

Compare coverage details, costs, and provider networks. Use online tools and consult with a professional. Read customer reviews and ratings.

Is Family Health Insurance Better Than Individual Plans?

Family plans often offer better value for multiple members. They provide comprehensive coverage and can be more cost-effective than individual plans.

What Are The Benefits Of Employer-sponsored Health Insurance?

Employer-sponsored plans often have lower premiums and better coverage. They may include additional benefits like wellness programs and preventive care.

Conclusion

Choosing the best health insurance for your family requires research and careful consideration. Understand your needs and compare plans.

Consult with professionals if necessary. The right policy ensures your family’s health and financial security. Make an informed decision for peace of mind and well-being.